www tax ny gov online star program

We recommend you replace any bookmarks to this. The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older.

Tax Basics Military Personnel And Veterans

See the STAR resource center to learn more.

. Visit wwwtaxnygovonline and select Log in to access your account. Please log back into your account to. Basic STAR is for homeowners whose total household income is 500000 or less.

External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. New York City residents. Only available to homeowners who have been receiving the STAR exemption on their same primary residence since 2015 and appears as as a reduction on the school tax bill.

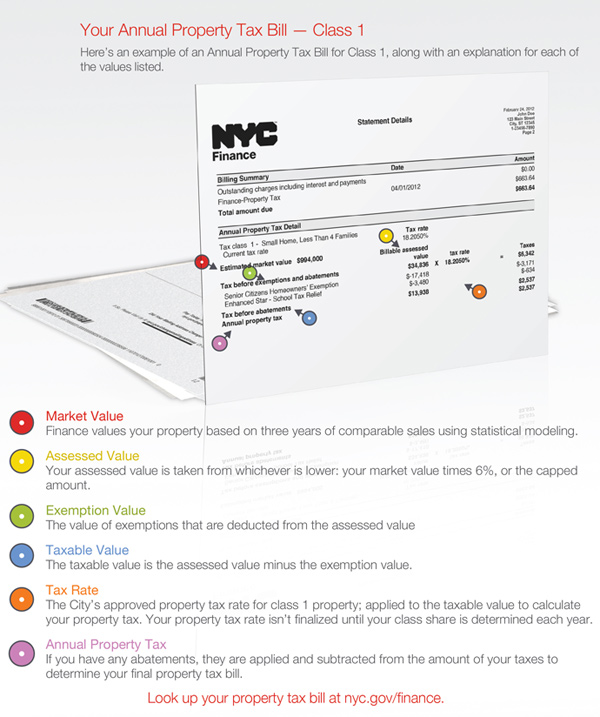

500000 or less for the STAR credit. STAR is the New York State School Tax Relief program that provides an exemption on a portion of school property taxes or a rebate check for owner-occupied primary residences. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein.

Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. This State-financed exemption is authorized by Section 425 of the Real Property Tax Law. If you are using a screen reading program.

Call 311 Outside New York City call 212-NEW-YORK Nassau County residents Glen Cove residents should follow the general application instructions above STAR forms. Homeowners not currently receiving STAR who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance. Your benefit may increase by as much as 2 each year.

The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners. The Village of Freeport has no role in administering this program. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and.

The income limit applies to the combined incomes of only the owners and owners spouses who reside at the property. Were processing your request. If you dont already have an account its easy to create one.

If you are using a screen reading program. The benefit is estimated to be a 293 tax reduction. You only need to register once and the Tax Department will send you a STAR credit check each year as long as youre eligible.

STAR exemption to register with the Tax Department in order to receive the exemption in 2014 and beyond Program applies to more than 26 million Basic STAR recipients Senior citizens receiving Enhanced STAR exemption are not impacted by this legislation All property owner questions should be directed to DTF at 518 457-2036 2. STAR Check Delivery Schedule. The following security code is necessary to prevent unauthorized use of this web site.

New York State Assembly Albany NY 12248 PRSRT STD. STAR lowers property taxes for eligible homeowners who live in New York State school districts. Enter the security code displayed below and then select Continue.

The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes. Receive your STAR check directly from New York State. The STAR program can save homeowners hundreds of dollars each year.

The following security code is necessary to prevent unauthorized use of this web site. Online Services is the fastest most convenient way to do business with the Tax Department. You can only access this application through your Online Services account.

There are 2 types of STAR exemptions or rebate checks - basic and enhanced. IMPORTANT INFORMATION ABOUT NEW STAR PROGRAM CHANGES IMPORTANT INFORMATION ABOUT NEW STAR PROGRAM CHANGES The School Tax Relief STAR program provides eligible. Enhanced STAR is for homeowners 65 and older whose.

Enter the security code displayed below and then select Continue. See Surviving spouse eligibility. 250000 or less for the STAR exemption.

This application is for owners who had a STAR exemption on the same property in the 20152016 tax year and wish to apply for Enhanced STAR. With an Online Services account you can make a payment respond to a letter from the department and moreanytime anywhere. US Postage PAID Albany NY Permit No.

Register for the Basic and Enhanced STAR credits. We changed the login link for Online Services. Exemption forms and applications.

There are two types of STAR benefits depending on household income. If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. The STAR program is the New York State School Tax Relief Program that provides an exemption from school property taxes for owner-occupied primary residences.

Haley Viccaro Hrviccaro Twitter

Enhanced Star Income Verification Program Ivp Enhancement Stars Income

Nyc Residential Property Tax Guide For Class 1 Properties

I R S Pushes Back Start Of 2020 Tax Filing Season The New York Times

Pin On Digital Marketing News Info